Most people looking at the mobile and smart phone sector focus on unit sales as an indicator of performance - I suggest that one also needs to look at apps. The number of available apps is a metric that shows developer commitment to the ecosystem and also gives the manufacturer marketing leverage (see Apple 100k apps marketing). Apps gives a good long term view of the platform and is a key driver in purchasing behaviour. Steve Jobs understands this which is why he plays the “most available apps of any platform” card at every possible opportunity.

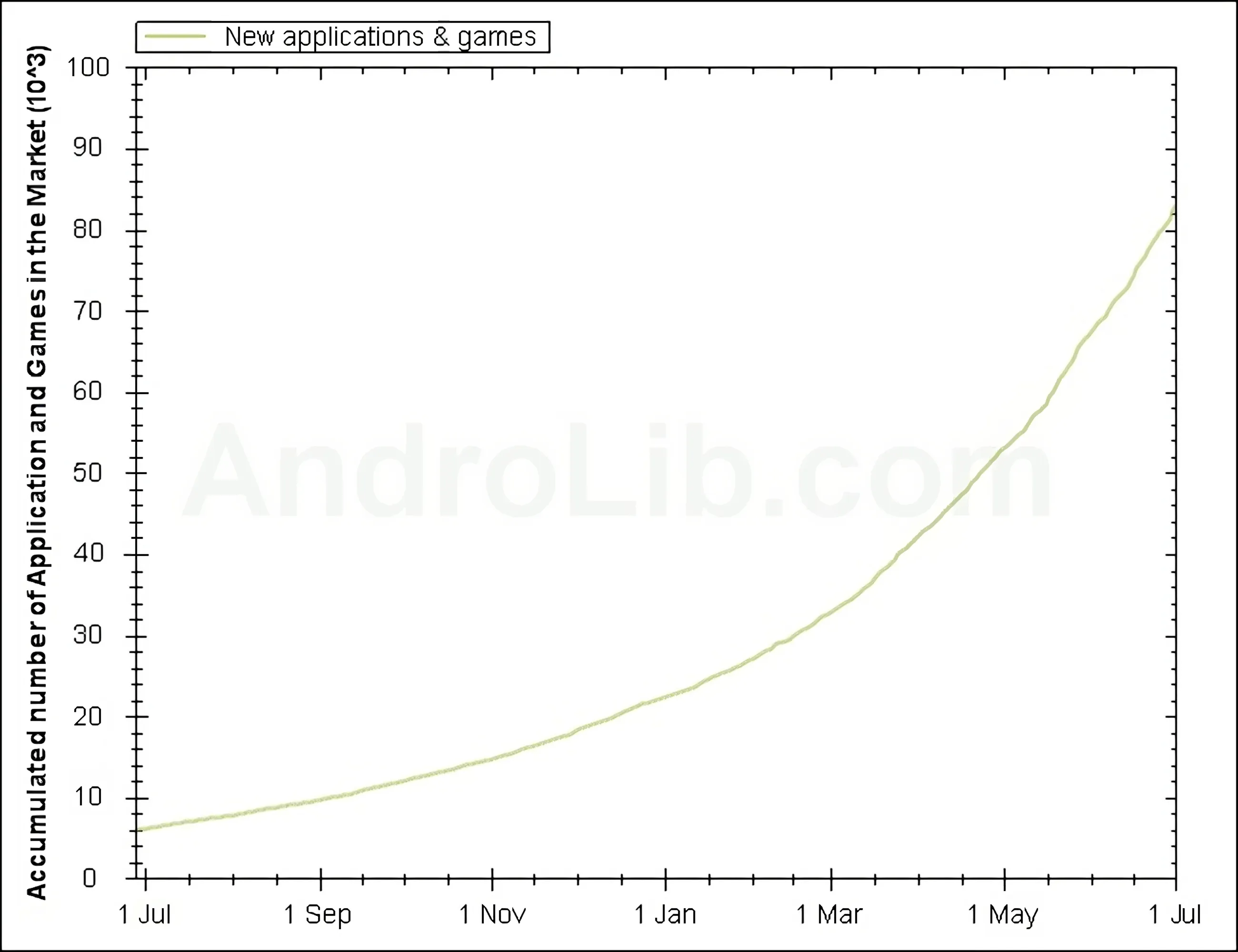

Well, Android has been enjoying exponential growth in the number of apps in the market over the last two years since it launched. This is not uncommon for a new platform and iPhone OS did exactly the same thing when it launched.

Number of apps in Android market - from androlib.com

Number of apps in Android market - from androlib.com

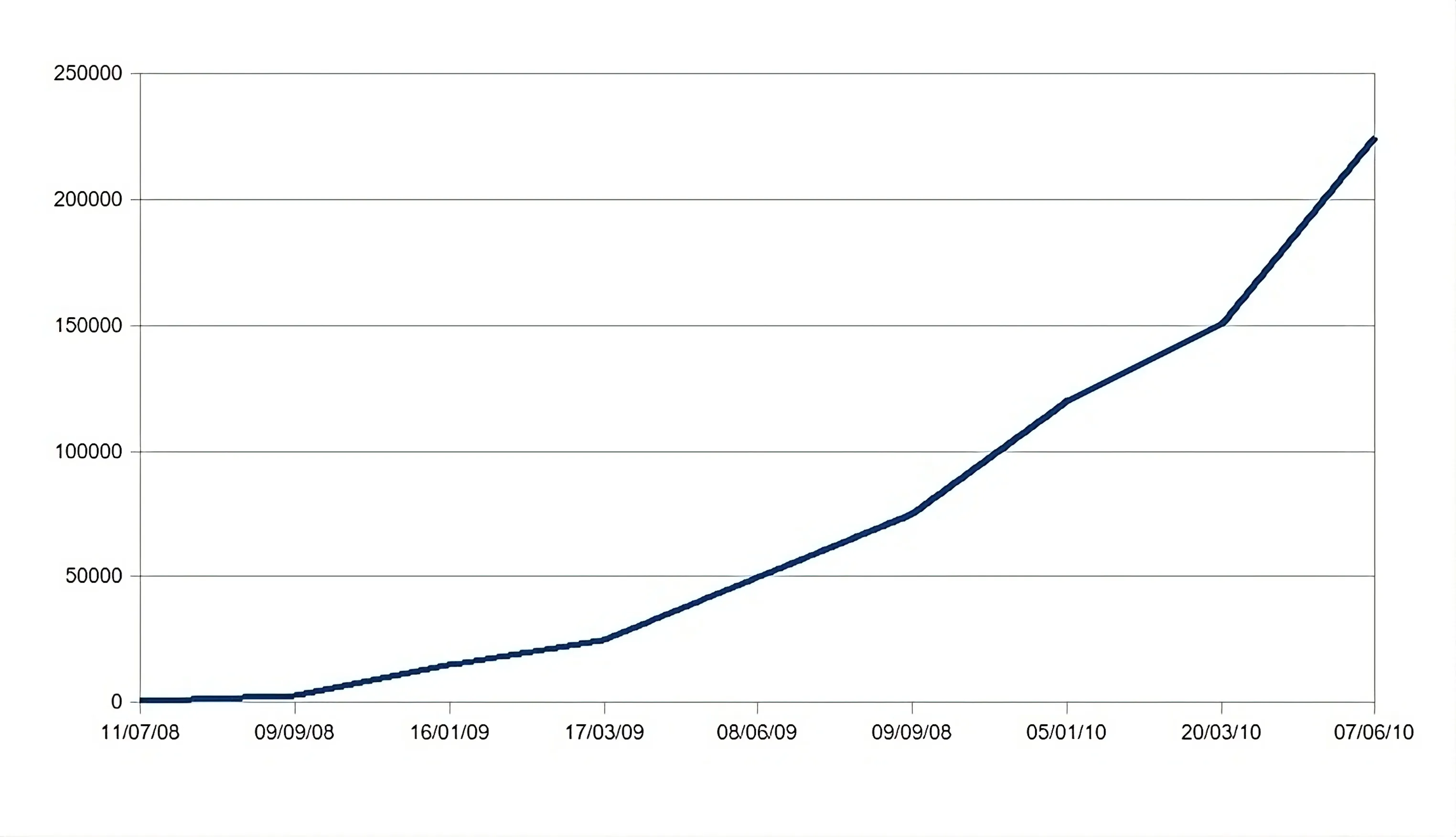

Why this is an important quarter for android however is that the number of apps currently available for Android was the inflection point at which Apple’s iPhone app growth stated to slow. As can be seen in the chart below iPhone apps have continued to grow but the pace has eased off. This is a sign that the developer community is saturating and is maturing.

Number of iPhone apps in iTunes - from Wikipedia

Number of iPhone apps in iTunes - from Wikipedia

I would suggest this also indicates that developers are becoming more considered about the types of apps they are building rather than doing quick, iterative development to just “try things out”. Certain niches are now evident in the iPhone ecosystem that revolve around the capabilities of the device and the ways people use them. The overall quality of apps are increasing too (anecdotally and as should be expected as a platform matures).

So we arrive at this point where a lot of the potential app space has been explored on a platform and development starts to plateau as developers get more serious about it, developing fewer, but better applications.

For iPhone OS, the point this occurred was at about 75,000 apps in the App Store. After this, the growth started to ease off.

At the end of June, the Android Market passed the 75,000 mark in number of published apps so this quarter will allow us to make some comparisons with the iPhone in a few key areas:

Is 75K the magic number?

Of all the potential insight this one interests me most as it’s behaviour driven. If Android, like iPhone OS, starts to slow after reaching 75,000 apps it tells us that this is the minimum number required before a mobile platform can claim maturity and a vibrant developer community. This number tells us you need to have about this many goes at developing apps by your community before a sufficient amount of space has been covered to start arriving at niches and maximising them through quality updates and competition.

This has enormous ramifications for markets being produced by Nokia, RIM (and potentially MS and HP). Anyone looking to contend in the smartphone market has to woo developers to get the market to this level as quickly as possible. Apple and Google have both done this extremely well through well designed developer programmes, lots of freebies and lots of conversation.

Is the Android strategy of having multiple handsets paying off?

One of the critiques around Android is that there are numerous vendors supplying hardware and lots of incompatible versions of the OS which is causing fragmentation. If the app growth remains strong, this could mean Android’s fragmentation isn’t as bad as everyone makes out as there are more potential niches to be had by developing apps that cater for different market segments around handset and OS version differences.

Likewise the extremely rapid rate of development on the hardware side could be opening up new potential development opportunities and use cases that don’t exist or didn’t exist comparably during iPhone’s growth. Arguably Augmented Reality (AR) is one of these areas; which saw explosive growth on the Android side and many of the market leaders then shifted to iPhone with well defined and highly polished products - killing off potential upstarts on iPhone before the niche was created.

Did Apple’s draconian app store policies stunt developer growth?

This will be hard to understand totally until we see Android catch up to iPhone in terms of total numbers of applications however we know that many developers were getting frustrated with Apple with regards to submission handling and this started occurring around the time that iPhone apps started to plateau so there may be some cause and effect here. Certainly if Android grows heavily in this quarter then some questions need to be asked about whether hampering developer freedom was worth it from a long term strategic standpoint.

Q3 big, Q4 bigger?

At this point it’s too early to tell. We know that Android is outselling iPhone heavily at the moment, even with the iPhone 4 release. Google announced at the Motorola Droid X launch recently that 160,000 handsets are being activated every day. Contrast this to about 95,000 from Apple (though this was pre iPhone 4 launch). Android sales also nearly doubled in as little as a month (100K units at I/O versus 160K at Droid X launch) so we can expect a number around 200K to some time in Q3 given this growth rate.

If you are a developer, you should be looking at those sorts of numbers and heavily considering an Android development strategy if you don’t have one already. The potential audience will be bigger long term and at this point there is opportunity to grab a niche - especially if you have an existing, polished iPhone app.

My prediction, for what it’s worth, is that we’ll see a doubling over Q3 and then a reduction occur over Q4. This will take the market to about 175K apps going into 2011. The strong platform demand will draw in a lot of developers - and Java is a much more readily available skill than Objective C so I think there’s still some legs in Android’s growth. Given iPhone’s current growth this would have the two platforms at similar levels of about 275,000 apps some time in the middle of 2011.

Time will tell and I’ll post an update at the end of Q3 as to the figures then.